Apartment investment effects after COVID-19 shelter in place order is partially lifted

Rent collections: Rents were not as affected as we expected. Nationally April 1-26 totaled 91.5% compared to 95.6% for the same period for 2019 (real page data). Some very surprising markets (Sacramento, Nashville, and Chicago) posted rent collections of 95.7% and greater.

Sales volume: Activity decelerated 1% in Quarter 1 (Q1) compared with same period in 2019, and slowed mid-March due to travel restrictions and shelter in place orders. Transaction volume weakened in the Q2 as sellers feared bringing their deals to market. Transaction volume is expected to significantly decline in Q2 and many deals will be on hold. However, off market transactions are still happening.

Sales volume by market: Investment sales slowed and in March we expect in Q2 2020 to deteriorate. Over the last 12 months top performing markets have been New York City, Los Angeles, Dallas-Fort Worth, Atlanta, Washington DC, San Francisco, Seattle, Phoenix, Houston, and Denver- all in that order by sales volume. It will be interesting to see how the next 12 months play out in these markets.

As we know New York had the largest issue with coronavirus deaths in March and April 2020. We think this may result in more people becoming suburban and moving away from densely populated areas. Places like Dallas-Fort Worth offer a more spread out city and has the same amenities and resources as major markets such as New York or Los Angeles. There are a few markets that we believe will shift and see an increase in net migration and therefore sales volume.

Investors have largely moved to the sidelines during COVID-19 but investment activity hasn’t fully stopped. For example, Barcadia sold over $200 million in multifamily sales in the second half of April. Compared to 1 Billion in 2019 is has greatly slowed.

Cap rates: Rates have been getting smaller the last 3/4 and quarter one we saw cap rate nationally rise to 5.47%. This is an early indication pointing towards yells adjusting after March. This means investors are seeking discounts compared to 2019 pricing.

Rent growth: Over the past year effective rent growth remained flat. In Q1 we saw .5% rent increase compared to 2019. Eight of the top 10 markets for rent growth are in the sun belt and this remains a strong opportunity for income growth even as we see rates slowing due to the pandemic.

Supply and demand: New supply for Q1 greatly outpaced demand. New supply was 70,319 units while demand was 42,714 units. New supply will likely be delivered in 2021. Inventory growth was strongest in Austin, Charlotte, and Orlando which saw large migration and job growth from 2010 to 2019.

Concessions: discounts to renters As of Q1 2020 look like this -Class C apartments are averaging 3.3% concessions, B Class apartments are offering 3.1% average concessions, and A Class has the highest concessions at 4.6%. Historically, C Class apartments had the highest concession amount after and during a global financial crisis. However, trends have flipped. As we travel more and utilize other spaces, it’s clear our homes are not the most important things. So living in a smaller and more efficient space is acceptable. Therefore, less people need A Class properties with amenities and high-end accommodations.

International capital: International capital has decreased 21% in the last 12 months. Interesting enough, 71% of acquisitions by international groups have been non-major or secondary markets. However, we believe this will shift to Core and essays which are considered to be safe havens. This will mean that secondary markets will likely see the first discounts if applicable. Secondary markets are secondary to a primary- for example Greenville texas to Dallas.

In the last 12 months the top five countries investing capital in the USA are Canada, Israel, South Korea, Netherlands, and United Kingdom. In that order.

This shows you the global confidence in the US market, and how it is changing.

Multifamily reserves from Fannie Mae and Freddie Mac Have increased

Fannie Mae reserve requirements for multifamily deals:

• For market rate deals <=65% LTV: 6 months of each of principal and interest (P&I) payments, taxes and insurance (T&I) escrow deposits, and Replacement Reserve deposits

• For market rate deals >65% LTV with an original unpaid principal balance (UPB) or a Supplemental Mortgage Loan UPB combined with the outstanding UPB of all Pre-Existing Mortgage Loans of greater than $6 million: 12 months of each of P&I payments, T&I escrow deposits, and Replacement Reserve deposits

• For market rate deals (same LTV parameters as above) with an original UPB or a Supplemental Mortgage Loan UPB combined with the outstanding UPB of all Pre-Existing Mortgage Loans, of $6 million or less: 18 months of P&I payments, plus 12 months of each of T&I escrow deposits, and Replacement Reserve deposits.

A few additional notes:

• These reserves can be released after one year if the property attains certain actual amortizing debt service coverage ratios (DSCRs) that are dependent on the specific loan program that the deal is processed under. For example, this would likely be 1.25 or 1.35 but depends on the leverage of the loan.

• The P&I reserve will not exceed 10% of the original Mortgage Loan UPB or, for a Supplement Mortgage Loan, 10% of the combined original UPB of the Supplemental Mortgage Loan plus the outstanding UPB of all Pre-Existing Mortgage Loans.

• Market rate properties with LTV <=55% are exempt from these reserves. Affordable Housing properties are also exempt where the property has either a project-based HAP (housing project) contract covering 100% of the units, or Low-Income Housing Tax Credit (LIHTC) with at least 8 years remaining in the initial 15-year compliance period.

• HUD deals still process in 45-69 days however underwriter assignment is 7-10 days. What does this mean? Slower than normal lending. How does this impact deals? We need longer due diligence and now contingencies exist.

Freddie Mac:

• Senior DSCR 12-month amortized debt service reserve. Released after 3 months if net rental income (NRI) and DSCR are higher than origination underwriting.

• New construction lending is severely limited.

Special servicing activity:

• Servicers have received 6,000 forbearance and relief requests, representing approximately 26% of the CMBS universe. 4% moved to special servicing.

• Coronavirus transfers to special servicing are less with loans approximately 3% of the CMBS universe.

Metechi et al.

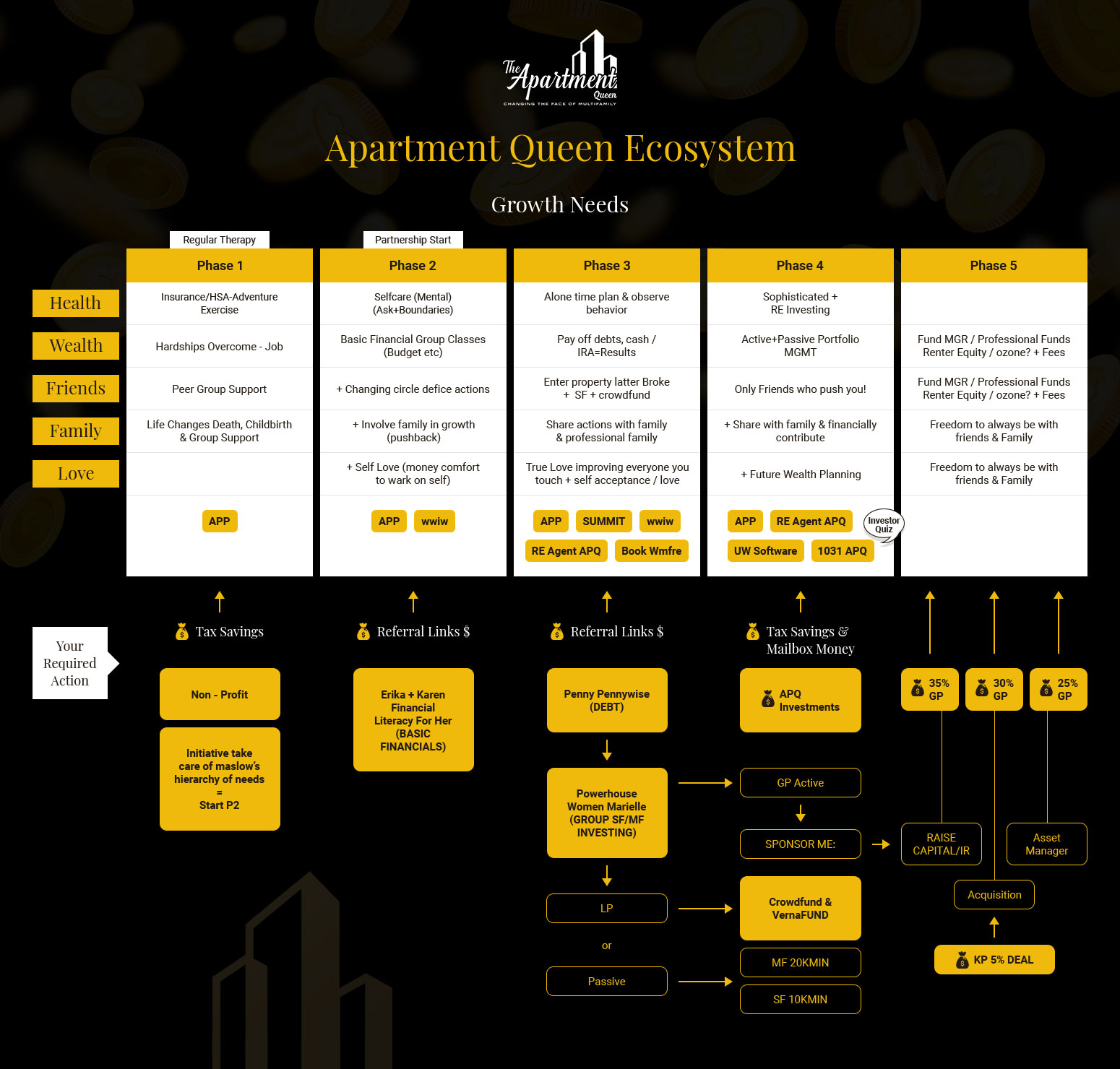

Currently, experts are predicting that banks will want to clean up their balance sheets Q4 2020, before 2021. So, until then we are focused on stacking cash and qualifying investors who want great investment opportunities moving forward. Our deals require that our investors are sophisticated or accredited. To find out which you are and to get on the list for future opportunities click here for our investor quiz:

“The Apartment Queen™ Investor Questionnaire” at: https://form.jotform.com/200207883604451

Moving forward: The strength of the real estate market is impacted by treasury bond prices, which are correlated to mortgage rates. When the stock market and real estate assets see volatility, investors will move their cash to bonds for stability and security. But as you could guess, as demand for treasury bonds increases, bond prices go up and guess what?!… yields (the interest paid to investors) fall. That pulls mortgage rates down, too.

Select markets with specific employment industries, like education, healthcare, government, and financial are expected to hold up well in the future if coronavirus hits again. The top markets are Washington DC, New York, Sacramento, Philadelphia, Baltimore, San Antonio, Boston, Los Angeles, Minneapolis, and Salt Lake City.